“SDFX Global RBI Approved: Everything You Need to Know About Regulatory Compliance and Forex Trading”

SDFX Global is a leading name in forex trading, and its status as RBI approved solidifies its credibility in the Indian market. For traders in India, ensuring that a forex platform is RBI approved is critical for adhering to local laws and avoiding potential legal issues. SDFX Global stands out as a platform that complies with the Reserve Bank of India’s strict regulatory standards, offering traders peace of mind.

By choosing SDFX Global RBI approved services, traders benefit from a platform that prioritizes transparency, compliance, and user protection, setting a benchmark in the forex trading space.

Why RBI Approval Matters for Forex Platforms

RBI approval for platforms like SDFX Global is essential because it ensures adherence to Indian financial regulations. Without RBI approval, forex trading platforms cannot legally operate in India. This approval indicates that SDFX Global complies with laws governing foreign exchange and customer protection, making it a safe choice for traders.

For investors, selecting an RBI approved platform like SDFX Global is not just about legality—it’s about ensuring a secure trading environment. Platforms without RBI approval pose risks such as fraud, data breaches, or financial penalties.

Key Features of SDFX Global RBI Approved Services

SDFX Global RBI approved services are distinguished by several features that cater to both beginner and experienced traders. Here’s what makes it a preferred choice:

- Regulatory Compliance: As an RBI approved platform, SDFX Global follows strict guidelines to ensure legal operations.

- User-Friendly Interface: The platform offers intuitive tools for seamless trading experiences.

- Comprehensive Forex Options: SDFX Global RBI approved services include a wide range of forex pairs, catering to diverse trading strategies.

- Advanced Security Measures: RBI approval demands stringent data protection protocols, and SDFX Global delivers on this front.

- Transparent Fee Structure: With no hidden charges, SDFX Global ensures clarity in all transactions, a hallmark of its RBI approval.

These features demonstrate why SDFX Global RBI approved status is a game-changer in the forex trading landscape.

How to Verify If SDFX Global is RBI Approved

Ensuring that SDFX Global is RBI approved is simple. The Reserve Bank of India provides a list of authorized forex trading platforms, which can be cross-verified through their official website. Additionally, SDFX Global prominently displays its RBI approval details, making it easy for users to confirm its compliance.

RBI approved platforms like SDFX Global are transparent about their regulatory status, unlike unverified platforms that often operate in legal grey areas. Always double-check documentation before trading to ensure you’re using a platform like SDFX Global that meets all regulatory requirements.

Benefits of Trading on SDFX Global RBI Approved Platform

Choosing SDFX Global RBI approved services offers several advantages that elevate your forex trading experience. Here are the key benefits:

- Legal Protection: Trading on an RBI approved platform like SDFX Global ensures compliance with Indian laws, protecting you from legal hassles.

- Financial Security: SDFX Global RBI approval guarantees secure transactions and robust anti-fraud measures.

- Access to Global Markets: With its RBI approved status, SDFX Global connects traders to international forex markets within legal boundaries.

- Educational Resources: SDFX Global offers tutorials and market analysis, ensuring informed trading decisions for beginners and pros alike.

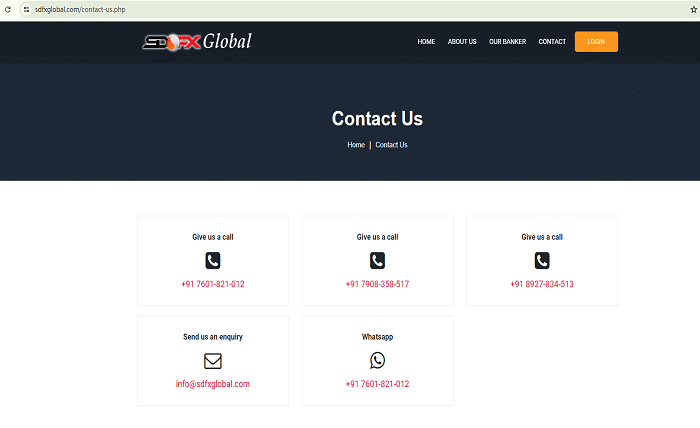

- Customer Support: As an RBI approved entity, SDFX Global provides top-notch support to resolve queries and issues efficiently.

These benefits highlight why SDFX Global RBI approved services are trusted by traders across India.

Challenges and Misconceptions About SDFX Global RBI Approval

Despite its credibility, SDFX Global RBI approved services face challenges, primarily due to misinformation about forex trading in India. Many traders wrongly assume that all platforms operating in India are RBI approved, which is far from true. This misconception can lead to losses or legal consequences for traders using unapproved platforms.

SDFX Global’s RBI approval sets it apart, but educating the public about verifying compliance remains crucial. Always confirm RBI approval before investing to ensure your chosen platform meets the necessary regulatory standards.

The Future of SDFX Global and RBI Approved Forex Trading

As forex trading gains popularity in India, platforms like SDFX Global with RBI approved status are poised to lead the market. The growing emphasis on regulation ensures safer trading environments, fostering trust among users. With advancements in technology, SDFX Global aims to introduce innovative tools and expand its offerings while maintaining strict compliance with RBI guidelines.

The future of RBI approved platforms like SDFX Global is bright, as they set the standard for ethical and secure trading in the ever-evolving forex market.

Conclusion

SDFX Global RBI approved services represent the gold standard in secure forex trading. By adhering to strict regulatory norms, the platform not only ensures legality but also builds trust among traders. Whether you’re new to forex trading or a seasoned investor, choosing a platform like SDFX Global with RBI approval is a wise decision. Protect your investments and trade with confidence on a platform designed to prioritize your financial security.

FAQs

1. What does it mean for SDFX Global to be RBI approved?

Being RBI approved means SDFX Global complies with the Reserve Bank of India’s regulations, ensuring legal and secure forex trading.

2. Is it safe to trade on SDFX Global RBI approved platform?

Yes, trading on an RBI approved platform like SDFX Global guarantees security, transparency, and adherence to Indian laws.

3. How can I confirm that SDFX Global is RBI approved?

You can verify SDFX Global’s RBI approval on the Reserve Bank of India’s official website or through the platform’s official documentation.

4. Are all forex trading platforms in India RBI approved?

No, not all platforms are RBI approved. Always check regulatory compliance before trading, as only approved platforms like SDFX Global are legal.

5. What makes SDFX Global stand out among other RBI approved platforms?

SDFX Global stands out for its user-friendly interface, robust security, and comprehensive forex options, all while adhering to RBI guidelines.